Property investors enjoying strong rental growth

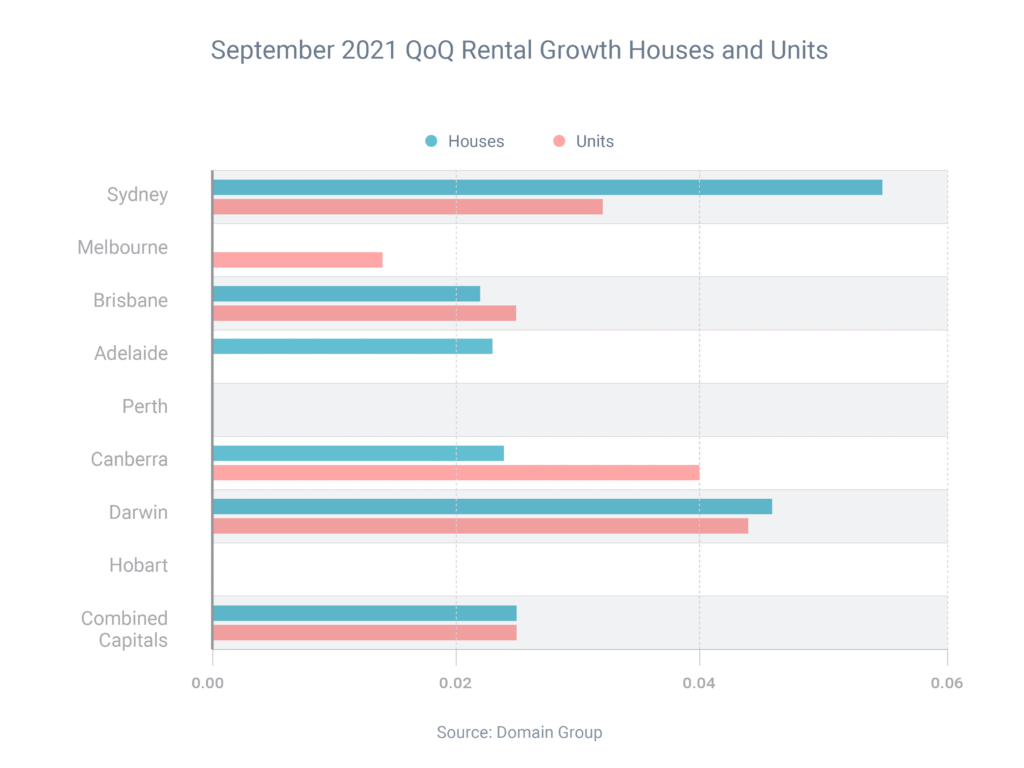

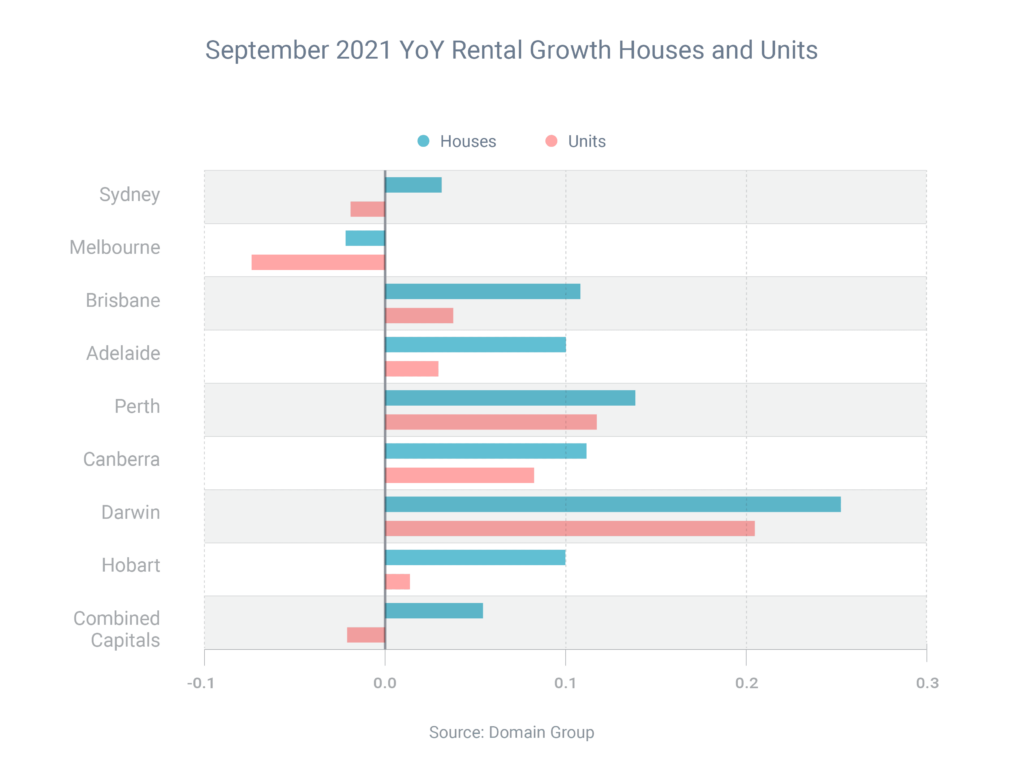

| House rents have climbed strongly in many parts of Australia, while some unit markets have also enjoyed strong growth, according to Domain. Over the year to September, capital city house rents increased by an average of 5.5% and six capital cities experienced double-digit growth. |

| During the same period, capital city unit rents decreased by an average of 2.1% – although rents actually increased in six capitals. |

| The reason rents are rising in many parts of Australia is due to an undersupply of rental properties; this has led to increased tenant demand for the limited amount of accommodation. In Perth, Adelaide, Hobart, Canberra and Darwin, the vacancy rate (the share of untenanted rental properties) is under 1.0%, according to SQM Research, which is incredibly low. In Brisbane, the vacancy rate is 1.4%, which is also low. But in Sydney and Melbourne, where rental growth is weaker, vacancy rates are above 2.5%. This is a good time to be a property investor, with rents rising, prices rising and vacancy rates falling in many parts of the country. Conditions are favouring landlords and those looking to enter the market.  |

Ready to get a new loan in a few minutes?

bjhbbjhbhj

vvhgv

-1482x635.png)